– so it’s important to be aware of which ones you qualify for and how they can help reduce your tax liability.

Eligibility criteria vary depending on which category you fall into – sole proprietorship, LLC, S-Corp, etc. Tax deductions are subtracted from your taxable income, reducing the amount you owe at year’s end. The IRS offers certain tax deductions for small business owners to help make the process of filing taxes easier and more efficient. Use Our List to Create a Small Business Tax Deductions Checklist for Your 2022 Tax Return.What is the maximum tax refund you can get?.What types of business expenses are tax deductible without receipts?.What is the 20% Business Tax Deduction?.How to Maximize Your Tax Deductions and Cut Your Taxable Income.

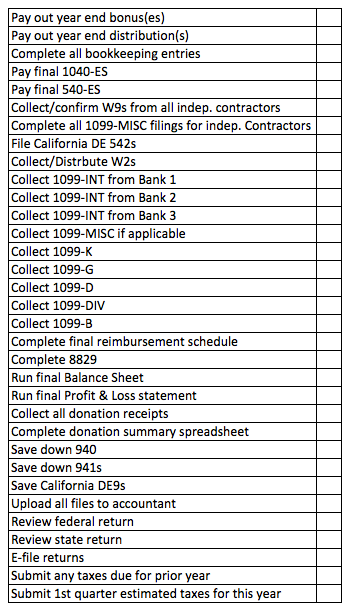

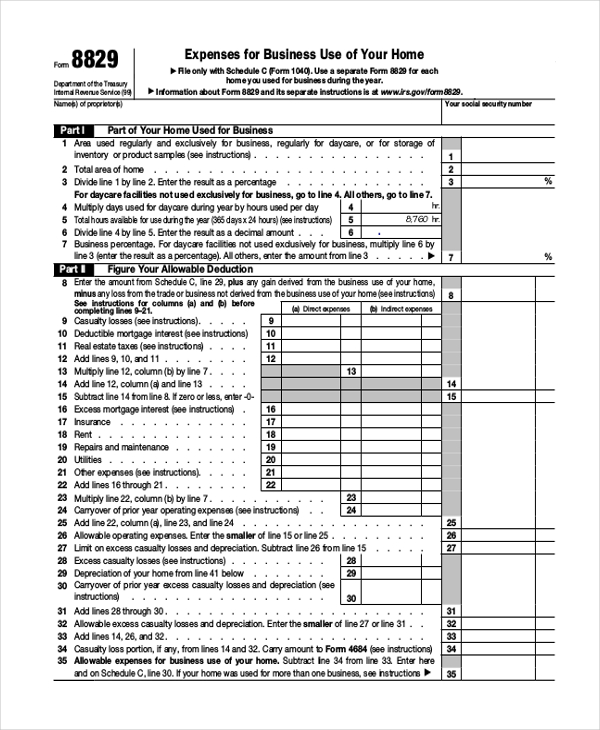

Step 2: Fill out the appropriate tax forms.How to Claim Small Business Tax Deductions for the 2022 Tax Year.Types of Tax Deductions for the 2022 Tax Year.

0 kommentar(er)

0 kommentar(er)